Affordable Care Act

Missouri insurance exchange to experience changes in 2017

By: Natalie Edelstein, Amber Sipe, Falyn Page and Yang Sun

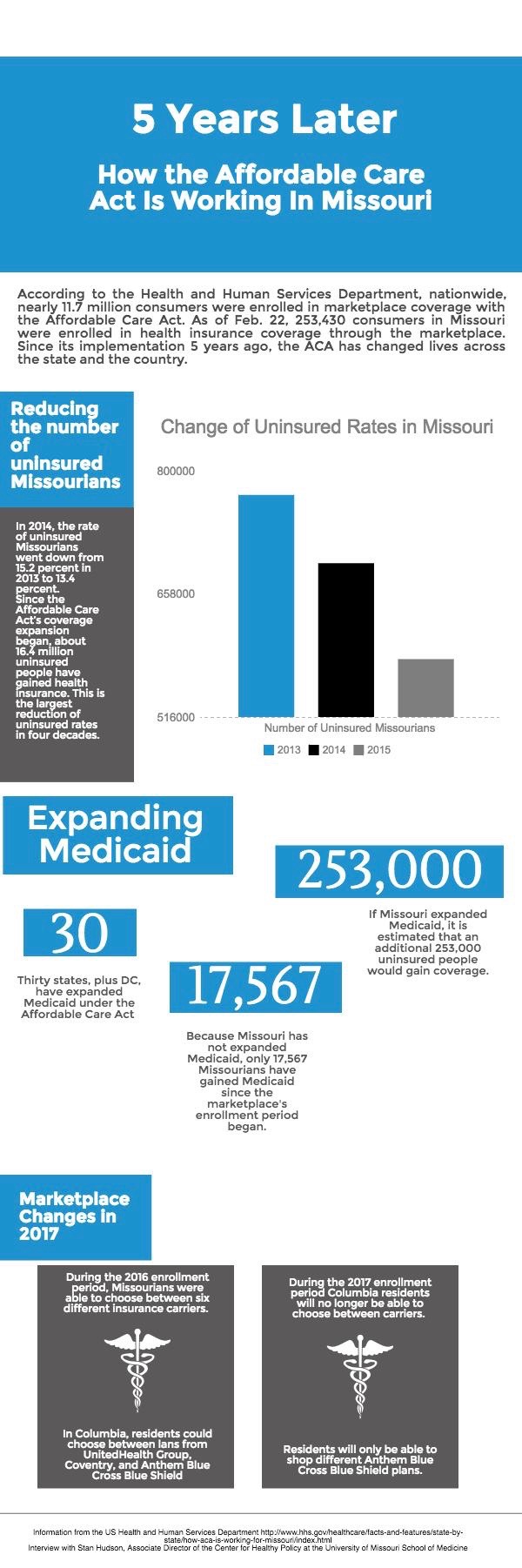

Five years after President Obama signed the Patient Protection and Affordable Care Act into law, the nation has seen significant shifts in both quality and access to healthcare. As insurers continue to enter and exit the marketplace under the act, the future of competitive premium rates in Missouri and elsewhere remains uncertain.

On Nov. 1, 2016 enrollment in the Affordable Care Act marketplace opens and Missourians will have to navigate yet another change in the insurance exchange.

At the end of 2016, Aetna and UnitedHealth Group will leave the marketplace in Missouri, and any plans previously offered by those insurers will no longer be available when the enrollment period begins in 2017. This leaves four insurers who will continue offering plans in Missouri’s marketplace. However, there is a major drawback to this. According to a study conducted by the Kaiser Family Foundation, insurance carrier participation tends to be localized. This means the majority of Missouri’s counties will be served by one carrier offering plans through the exchange in 2017. While counties like Saint Louis and Kansas City will have more than one insurer offering plans, 96 of Missouri’s 114 counties will be limited to one insurer.

At the end of 2016, Aetna and United HealthCare will leave the marketplace in Missouri, and any plans previously offered will no longer be available. This leaves four insurers who will continue to offer plans in Missouri’s marketplace. But, according to a study conducted by the Kaiser Family Foundation, insurance company participation tends to be localized. This means that most of Missouri’s counties will have only one plan available through the exchange.

Stan Hudson, the associate director of the Center for Health Policy at the University of Missouri School of Medicine, said that while there will still be several plans to choose from, the lack of insurers in 2017 severely limits the choices residents have.

“For example, here in Columbia for 2017 we’re just going to have a choice, if you go on the marketplace, between different Anthem Blue Cross Blue Shield Plans,” said Hudson. Missourians are still able to choose between several different plans, but they will not have a choice between carriers.

“So it’s one carrier and there are lots of different plans that you can choose form but it still limits the choice and there are other counties in Missouri that are only going to have one carrier this year,” he continued.

However, residents and professionals alike are uncertain of the uncertain of how the insurance marketplace will change in 2017. It is expected that in the short term, rates will rise. Among the four insurers still offering plans in the marketplace, Humana has the highest proposed rate increase of 34.9 percent, with Blue Cross Blue Shield of Kansas City coming in second place at 29 percent.

Hudson explains in the short term premiums will rise, but across the country there has been a push to recruit healthier people to enroll in the marketplace.

“You’re actually seeing a few plans in places actually decreasing their premiums because they did do well in recruiting and getting a good pool of healthy folks in their insurance plans but in the short-term at least initially, premiums are probably going to continue to rise.

If Missouri insurers can do a good job at recruiting young people into the marketplace, the premium problem may be solved. However, if more carriers continue to exit the marketplace, it will leave fewer and fewer options for Americans utilizing the Affordable Care Act’s marketplace.

Missouri is currently one of four states that do not have an effective rate review process for Affordable Care Act-compliant plans. This means the state does not play an active role in reviewing proposed rates. Additionally, 30 states including DC have chosen to expand Medicaid, while Missouri has not. Medicaid expansion is one of the key components of the Affordable Care Act, and according to The Health and Human Services Department only 17,567 Missourians have gained Medicaid since the beginning of the insurance marketplace’s first open enrollment period.

Due to not having a rate review process and not expanding Medicaid, Missouri is different from most states using the Affordable Care Act. When it is time for enrollment in 2017, no one knows whether or not enrolling healthy people into the marketplace will be successful.

Tom Pauley, owner of Pauley Insurance Agency, explains that the Affordable Care Act has many different implications for insurers and residents alike on Oct. 14, 2016 in Columbia, Missouri. Pauley says that as both an insurer and a consumer, he has seen the act both help and hurt people.

Stan Hudson, associate director for the Center of Health Policy at the University of Missouri School of Medicine, reviews Missouri’s marketplace insurance options on Wednesday, Oct. 19th, 2016 in Columbia, Missouri. Hudson explains that Columbia residents will only be able to choose between Anthem Blue Cross Blue Shield plans during the upcoming enrollment period.

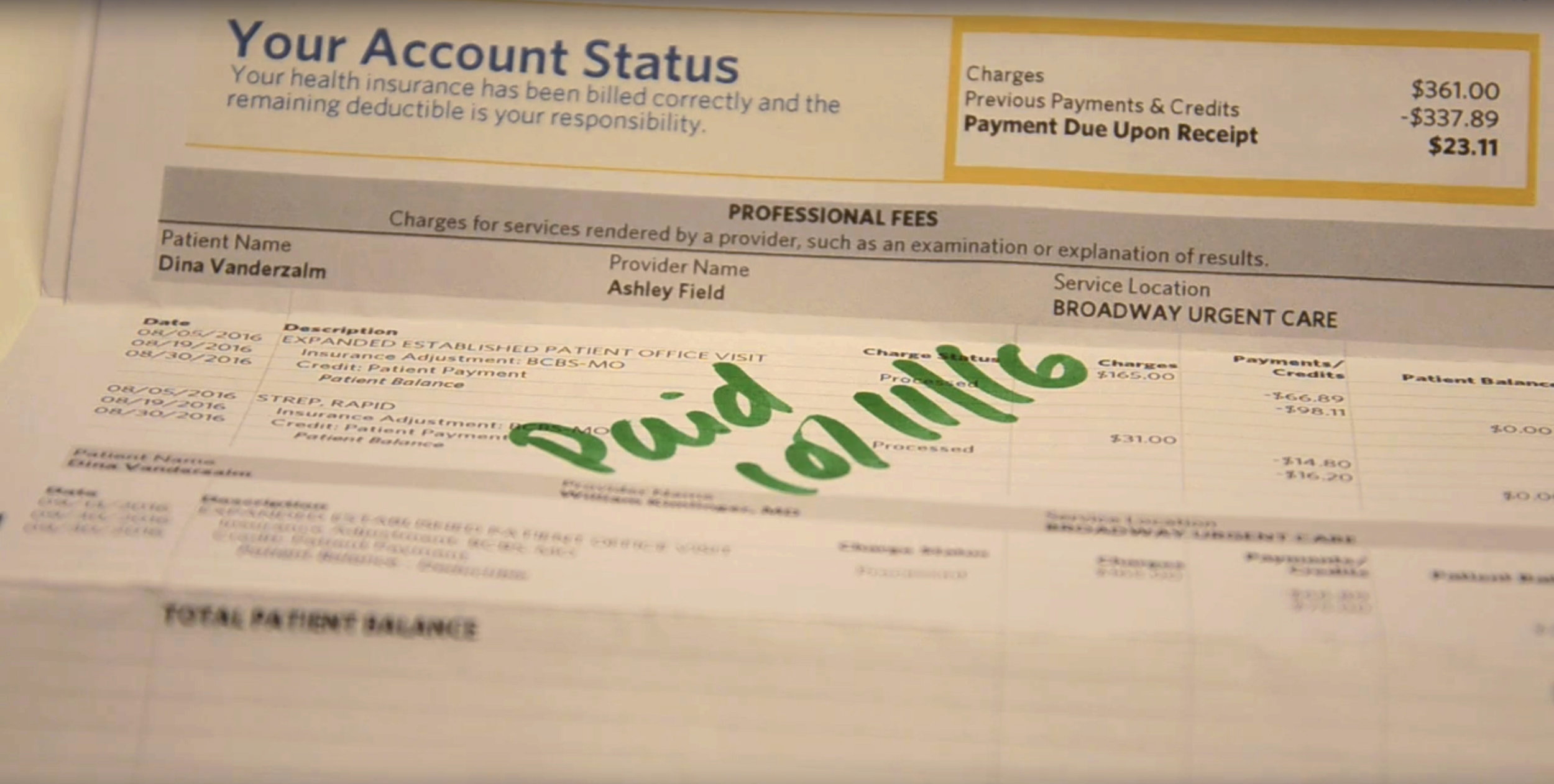

Dina van der Zalm smiles as she looks over her last few monthly statements on Thursday, Oct. 13, 2016 in Columbia, Missouri, in Columbia, Missouri. She says that the Affordable Care Act has provided her with quality healthcare, but kept her premiums low.

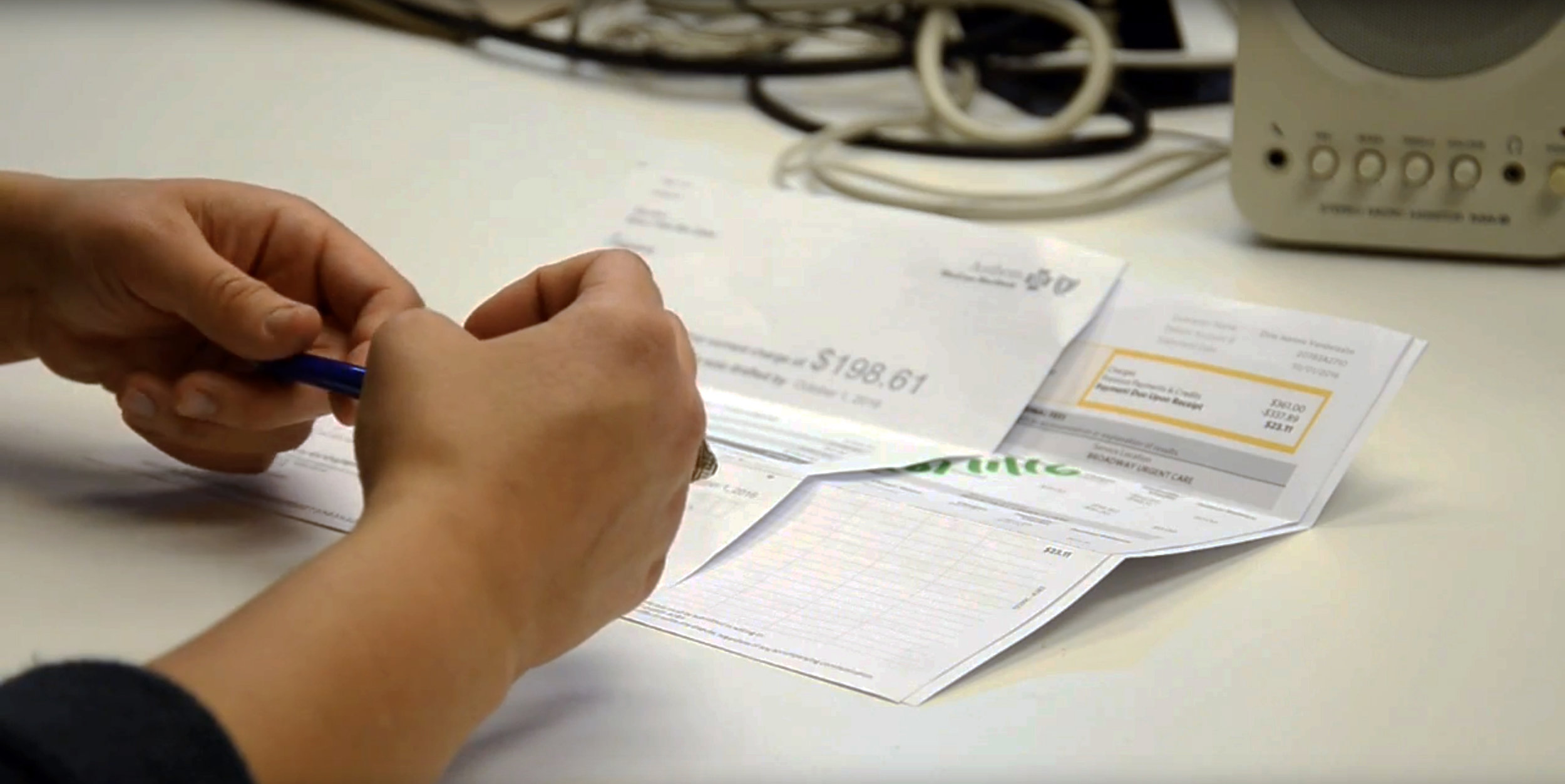

Dina van der Zalm looks over her copayment on her Anthem Blue Shield Blue Cross bill l on Thursday, Oct. 13. 2016 in Columbia, Missouri. She only needs to pay $23.11 for this month, which she says is something she can handle.

Dina van der Zalm reviews her latest medical bill on Thursday, Oct. 13, 2016 in Columbia, Missouri. Because of the Affordable Care Act, van der Zalm says medical expenses are not something she stresses about anymore.